Introduction:

For investors, keeping track of earnings reports can be essential to maximizing their investment opportunities. By staying informed about when companies release their financial results, investors can make more informed decisions about buying, selling, or holding stocks. Fortunately, there are several online tools available to help investors track upcoming earnings reports, known as earnings calendars.

Body:

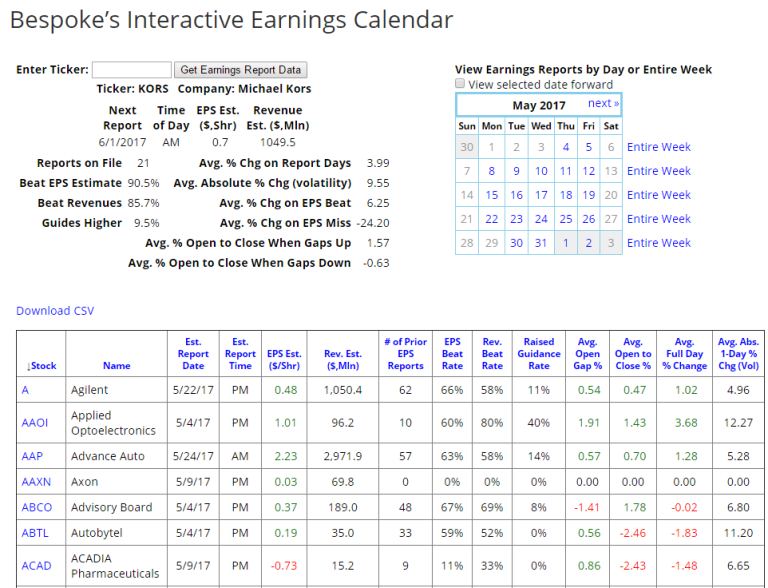

An earnings calendar is a schedule of when companies are expected to release their quarterly or annual financial reports. The calendar typically includes the date and time of the report, the company’s name, and the expected earnings per share (EPS) or revenue for the period. This information is critical for investors as it helps them to gauge a company’s financial health, potential growth opportunities, and future prospects.

There are several types of earnings calendars available online, ranging from free to paid subscriptions. Some of the popular earnings calendars include Yahoo Finance, Earnings Whispers, Zacks Investment Research, and Seeking Alpha. These calendars provide investors with a comprehensive overview of the upcoming earnings reports, including the date and time of the report, analyst consensus estimates, and historical data.

By tracking the earnings calendar, investors can gain insights into the market sentiment and identify potential buying or selling opportunities. For example, if a company is expected to exceed its earnings estimate, the stock price may rise, and investors may choose to buy the stock before the earnings report is released. Similarly, if a company is expected to miss its earnings estimate, the stock price may fall, and investors may consider selling the stock before the earnings report is released.

Moreover, the earnings calendar can help investors identify trends and patterns in the market. For instance, if several companies in the same industry are reporting lower-than-expected earnings, it may suggest a broader economic slowdown or a problem specific to the industry. In contrast, if several companies in the same industry are reporting better-than-expected earnings, it may indicate a growth opportunity for the industry.

Conclusion:

In summary, keeping track of the earnings calendar is an essential tool for investors to stay informed about the financial health and future prospects of companies. By using an earnings calendar, investors can make more informed decisions about buying, selling, or holding stocks, based on the expected earnings per share (EPS) or revenue for the period. In addition, the earnings calendar can help investors identify trends and patterns in the market, enabling them to take advantage of potential investment opportunities.

FAQs:

Q: Can an earnings calendar predict the exact stock price movement? A: No, an earnings calendar cannot predict the exact stock price movement. It can provide investors with an estimate of the earnings or revenue for the period, which may influence the stock price. However, there are many other factors that can impact a stock’s price, such as market sentiment, geopolitical events, or industry trends.

Q: How often is the earnings calendar updated? A: The earnings calendar is typically updated in real-time as companies announce their earnings report dates. Most online tools provide daily or weekly updates to their earnings calendars, depending on the level of subscription.

Q: Is it necessary to subscribe to a paid earnings calendar service? A: No, it is not necessary to subscribe to a paid earnings calendar service. There are several free tools available, such as Yahoo Finance, Earnings Whispers, Zacks Investment Research, and Seeking Alpha, that provide investors with comprehensive information about upcoming earnings reports. However, paid services may offer additional features, such as customizable alerts, detailed analyst estimates, and historical data, that may be useful for some investors.